Suggs Insurance Agency

Insurance Services in Lillington, NC

Just down the road from Lillington, our Sanford-based team delivers the personal service Harnett County families and businesses deserve.

Local Support for Harnett County Neighbors

Lillington, we're right around the corner. Suggs Insurance Agency is based in Sanford, and we proudly serve clients across Lillington and Harnett County - including nearby communities like Buies Creek, Angier, Coats, and Bunnlevel. We understand that coverage needs here can look different than the big city: multi-vehicle households, country homes, small businesses, and the kind of community pride that values relationships. Whether you want to stop by in person or handle everything by phone, email, and text, we make it easy to get reliable coverage without the runaround.

Trusted by Families Across Central NC

John Smith

John Smith

What We Offer Locally in Lillington

Looking for affordable auto insurance in Lillington? We compare options across multiple carriers and help you choose coverage that protects you on the road and fits your budget.

From small-town neighborhoods to rural properties across Harnett County, we help tailor home coverage for your structure, belongings, and liability.

Protect your family's future with term, whole life, or final expense options. We'll help you decide how much coverage makes sense-without pressure.

Need help understanding plan options or enrollment timing? We guide individuals and families through health coverage choices with local support.

For local shops, trades, and service businesses, we build commercial coverage that helps protect your property, operations, and liability.

Have a motorcycle, boat, or RV for weekends and family time? We can help insure your "toys" right alongside your everyday policies.

Insurance Help That Feels Like Home

Why Choose Us

Why Lillington Clients Choose Suggs Insurance

Close Enough for Face-to-Face Service

Our office is a quick drive from Lillington, and we welcome walk-ins. If you like knowing where your agent is, you'll love the convenience.

Rural and Small-Town Coverage Experience

We understand the mix of rural and suburban life in Harnett County and help clients protect what matters-without overcomplicating the process.

Independent Options, Better Fit

As an independent agency, we compare policies from multiple carriers to help you find the right coverage and pricing for your situation.

Bilingual Support When It Matters

Hablamos Español. Nuestro personal bilingüe está listo para ayudar a la comunidad hispana de Lillington con sus seguros.

Lillington, Let's Get You Covered

If you're in Lillington or anywhere in Harnett County, contact Suggs Insurance Agency for a free quote or coverage review. We're just down the road - and ready to earn your trust with honest guidance and friendly service.

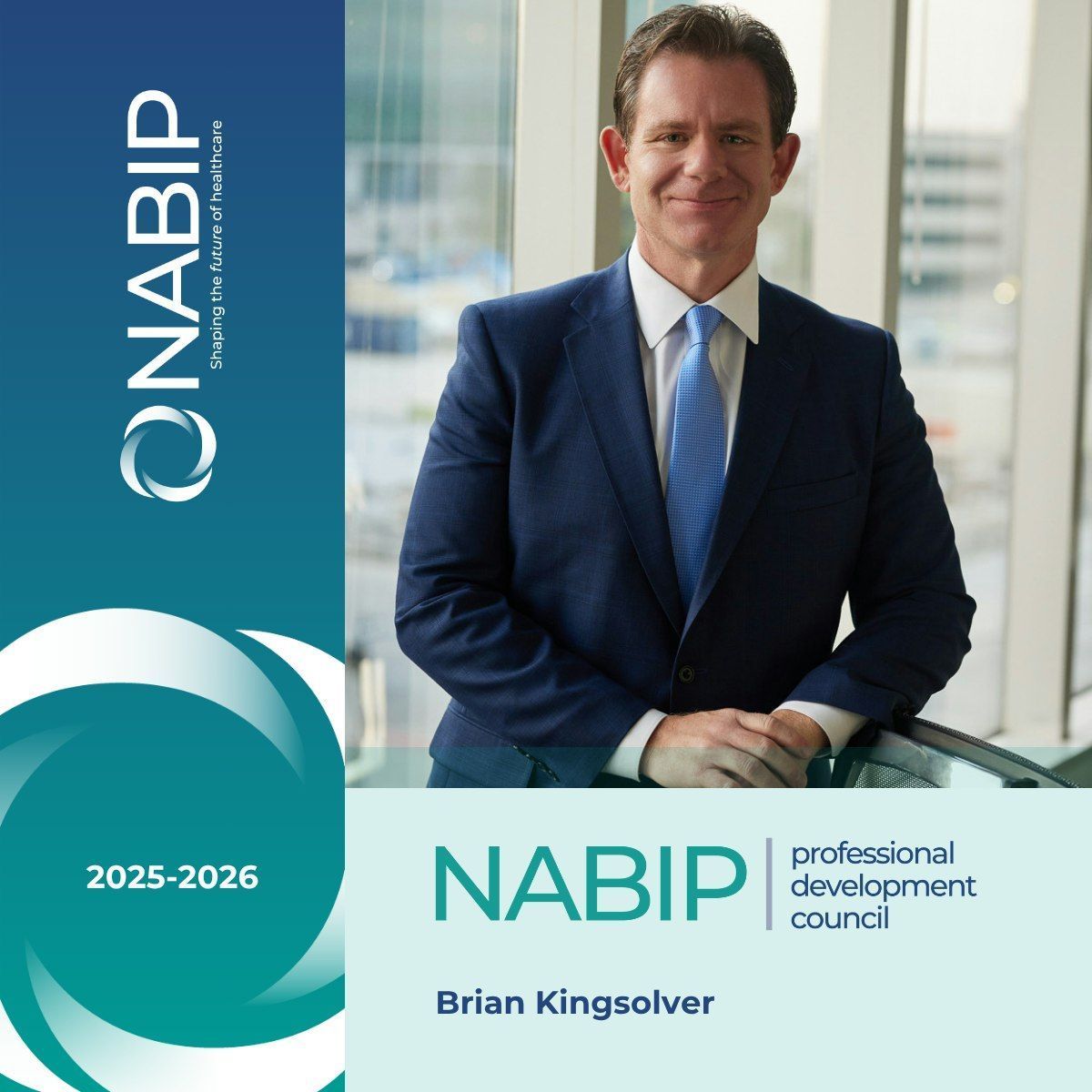

Accreditations & Awards

Recognized for Excellence in Client Service

Opportunity Insurance Agency is honored to be recognized for our commitment to serving clients with clarity, integrity, and personal attention. Our achievements include being named a Top Medicare Advantage Services Provider for 2024 by ElderCare Review, celebrating CEO Brian Kingsolver’s appointment as Regional 4 Chair for the NABIP Professional Development Council for 2025–2026, and earning the Elite Circle of Champions 2025 designation for helping 100–499 individuals and families enroll in qualified health coverage. These honors reflect our ongoing dedication to delivering exceptional service and trusted insurance solutions across the country.

Your Questions, Answered Honestly

Real Answers From Real People

Do you only work with certain insurance companies?

No. As an independent agency, we’re not tied to any one carrier. That means we shop multiple options and recommend what’s actually best for you—not what’s best for them. This independence lets us focus on your needs instead of meeting a sales quota.

Can you help if I’m turning 65 and new to Medicare?

Yes. Medicare is complex, but we break it down step by step. We’ll help you understand your options for Original Medicare, Medicare Advantage, and Part D plans, and explain how to avoid penalties. Whether you want to keep your current doctors or need extra benefits, we’ll guide you every step of the way.

Do I have to pay for your services?

No. Our services are free to you because we’re compensated by insurance carriers when you enroll. But our commitment is to you—not them. We don’t push products; we focus on helping you make the right decision.

Can small businesses offer health insurance affordably?

Yes, and it’s often more doable than you think. We help business owners design benefits packages that balance cost and coverage, whether you’re a team of five or fifty. Offering group health doesn’t have to break your budget—we’ll show you smart options that work.

Do you work with clients outside your state?

Absolutely. We serve clients nationwide with virtual meetings and secure tools, so you get the same level of personal service no matter where you are.